A powerful, accessible, and secure mobile banking experience built for FICB Core clients.

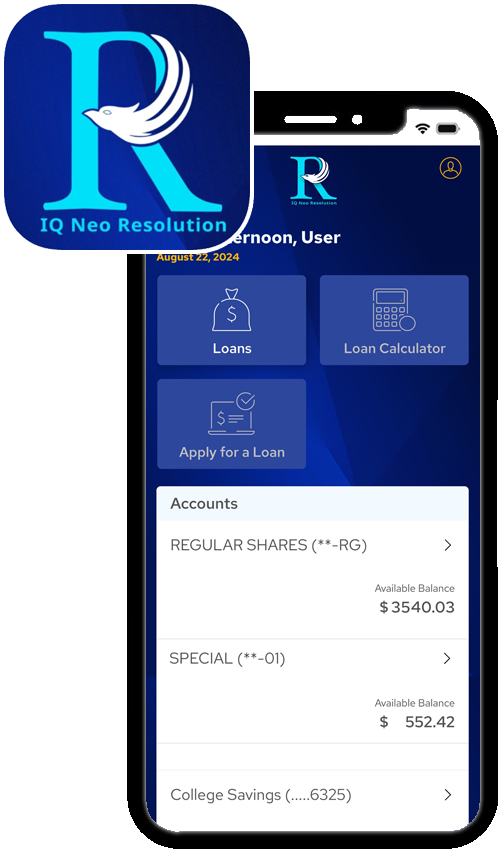

Meet the IQ Neo Banking App

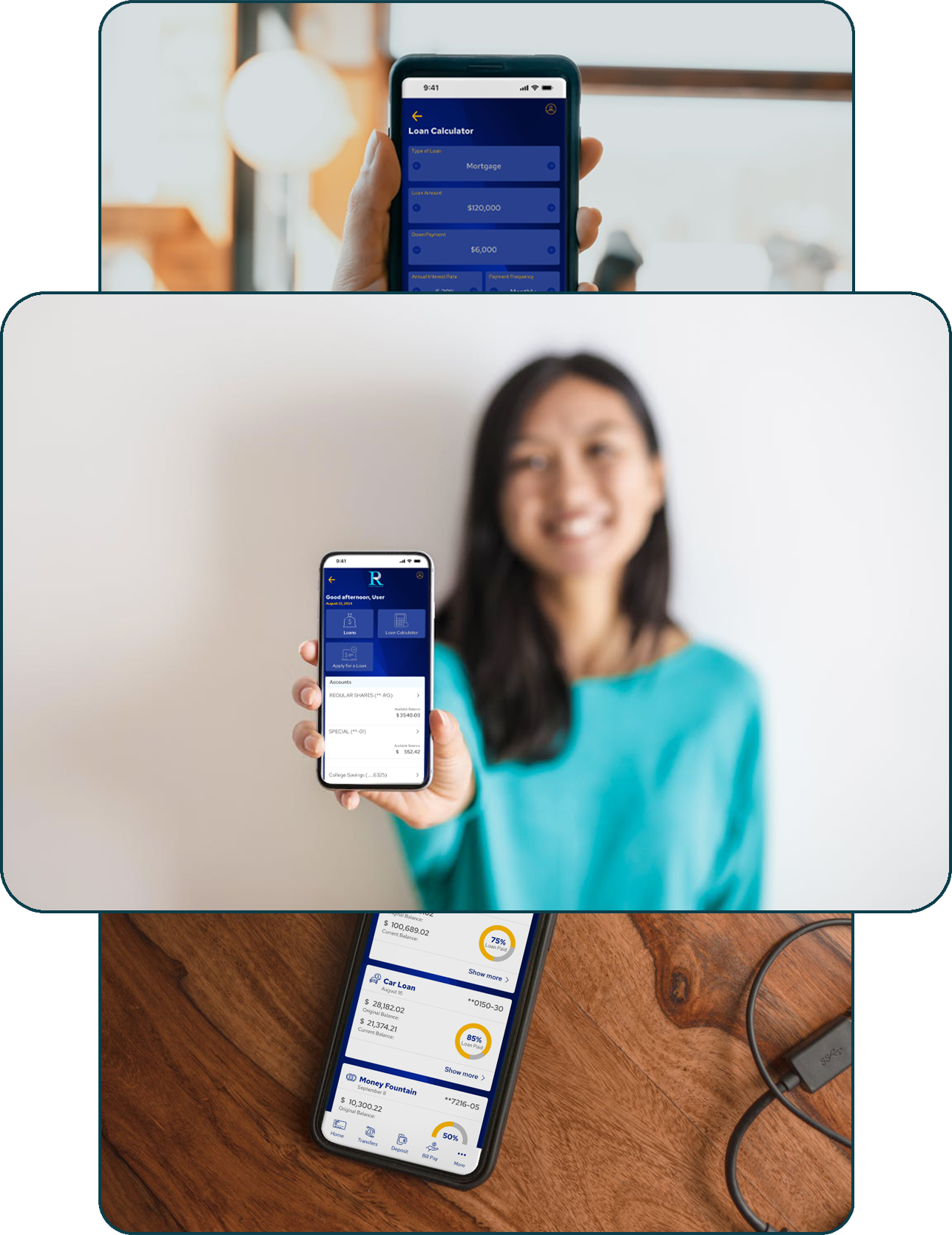

Modern, Intuitive Design

A clean, user-centric interface that ensures a low-friction experience for both new and long-time users. Simple screens and options to minimize errors.

Seamless FICB CORE Integration

Real-time data synchronization between the app and the core system means members always have access to up-to-the-second account balances and transaction history.

Built-in Security

Increases member trust with built-in security protocols and 24/7 fraud monitoring, providing peace of mind in every mobile transaction.

App Store Ready

Fully compliant with Apple and Google guidelines, the app is ready for immediate deployment and adoption.

How IQ Neo Benefits FICB Core Clients

Empower Members

24/7 mobile access to account details, transactions, and payments—anywhere, anytime.

Reduce Operational Load

Self-service tools cut branch traffic, freeing staff to focus on high-value member interactions.

Build Trust & Credibility

A polished, modern app reinforces institutional professionalism and commitment to member service.

Compliance & Protection

ADA compliance, continuous updates, and strong security help safeguard your institution.

Future-Ready Platform

Designed to grow with you—IQ Neo is the foundation for FICB’s expanding digital ecosystem.

IQ Neo is more than a mobile app—it’s the digital front door of FICB CORE. It elevates the member experience, strengthens institutional trust, reduces operational strain, and delivers a secure, accessible platform built for the future of digital banking.